The last 1.5 years since beginning of 2020 had been an extremely difficult time for people all over the world. Pandemic did not spare anyone. Rich, poor, religion, creed, haves, have-nots, white, black, brown...nothing - the Corona virus impacted everyone equally. Unfortunately, it did effect the economically struggling class more rapidly than others who fortunately could avail medical facilities with insurance, investments or personal savings.

This pandemic had been a great eye opener for all of us and it is very important wake up call to address emergencies not just this one, but anything going forward. However, handling the crisis and managing emergencies for many during the last many months, have made me repeatedly emphasis on adequate financial planning and staying safe during these unprecedented times.

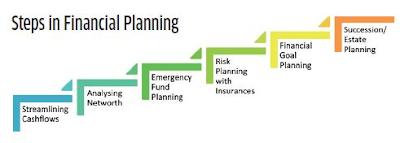

Here are few of the learnings that I would like to share:

Using Digital banking for all financial needs

It may sound silly, but cash had been the biggest carrier of the contagious virus and carrier during the times of Corona crisis as it changes hands quite rapidly. The risk of contamination is very high when it comes to handling cash for transactions. Using internet banking, online tools like PayTM, GPay, Pockets is effecting for goods and transactions from the comfort of our homes and staying safe during pandemic

Adequate Health Insurance

It is very important that we have enough insurance coverage to handle crisis during this pandemic. It is very important to have sufficient medical insurance cover for you and your family to safeguard your financial state in case of a medical emergency and also to avail required medical facilities. Having the details of the insurance card, government provided medical insurance using Aadhar Card and company id card and manager / insurance desk contact numbers handy and informed to all members in the family is a must. Take Top-up cover in case you have any morbid conditions that may require additional medical support

Life insurance Details

Indians especially have this mind-block when it comes to talking about death and planning in case we are gone. It is very important that the family should not suffer financially when the emotional and physical trauma of a bereavement is there in the family. So insurance policy details and insurance helpline numbers, agent details, and original policy documents available place details should be shared with all the family members. Life insurance is the biggest protection to the family even after we are gone

Nomination Details

Many times, we are so selfish that we fail to update and keep track of the nomination details to our holdings, be it bank accounts, lockers, insurance policies, investments, shares, trade documents or planning of WILL for our immovable assets like buildings, farms and houses. The struggle of the legal heirs is unimaginable when the nomination details are not updated for these investments. So it is important to update nomination, keep a copy of the investments and keep your family or the nominee informed with the legal documents so claims become easy for them when the situation happens

Emergency Funds

Many of us in the rat race for survival forget to keep aside funds to manage unpredicted emergencies. There should be funds kept aside to manage anywhere from 3 to 6 months during the crisis, In case of any incapacitation due to Covid or any disease or loss of job due to the economic splurge that is happening, these funds will help you meet the basic needs of survival of your family and opportunity to bounce back both physically and financially without losing confidence

Being ALERT is Important

It is very important that we stay alert of the fraudsters on Internet during this pandemic. Having very unpredictable passwords only known to family is important for all online login ids and also it is very important to have an add-on debit card in the name of a spouse or a child for handling emergency. It is also important that you keep your ATM Pins and cards safe and ensure you key in 000 after you finish you withdrawals in ATM to ensure the keypad don't record your PIN.

Do not share your passwords or PINs to anyone on phone/ email or calls / google docs/ links/ or to even to those who claim are from Bank, Insurance company, Govt or IT agency / RBI/ Covid care centers or even if some personifies like a relative or friend. Or tries to create a panic situation where you share everything in emotional vulnerability times. Do not transfer money in those panic situations especially to any individual accounts. Being ALERT is important not to end up bankrupt

Stay Home! Stay Safe! Stay Secure!!!